Daily Stock Picks: Non-S&P 500

#1 Pick: AMG

PEG Ratio: 0.12 | P/E Ratio: 14.47 | Dividend Yield: 0.01%

Company Description

Affiliated Managers Group, Inc., through its affiliates, operates as an investment management company providing investment management services to mutual funds, institutional clients,retails and high net worth individuals in the United States. It provides advisory or sub-advisory services to mutual funds. These funds are distributed to retail, high net worth and institutional clients directly and through intermediaries, including independent investment advisors, retirement plan sponsors, broker-dealers, major fund marketplaces, and bank trust departments. The company also offers investment products in various investment styles in the institutional distribution channel, including small, small/mid, mid, and large capitalization value and growth equity, and emerging markets. In addition, it offers quantitative, alternative, and fixed income products, and manages assets for foundations and endowments, defined benefit, and defined contribution plans for corporations and municipalities. Affiliated Managers Group provides investment management or customized investment counseling and fiduciary services. Affiliated Managers Group, Inc. was formed in 1993 and is based in West Palm Beach, Florida with additional offices in Prides Crossing, Massachusetts; Stamford, Connecticut; London, United Kingdom; Dubai, United Arab Emirates; Sydney, Australia; Hong Kong; Tokyo, Japan, Zurich, Switzerland and Delaware.

Industry & Sector

Industry: Asset Management | Sector: Financial Services

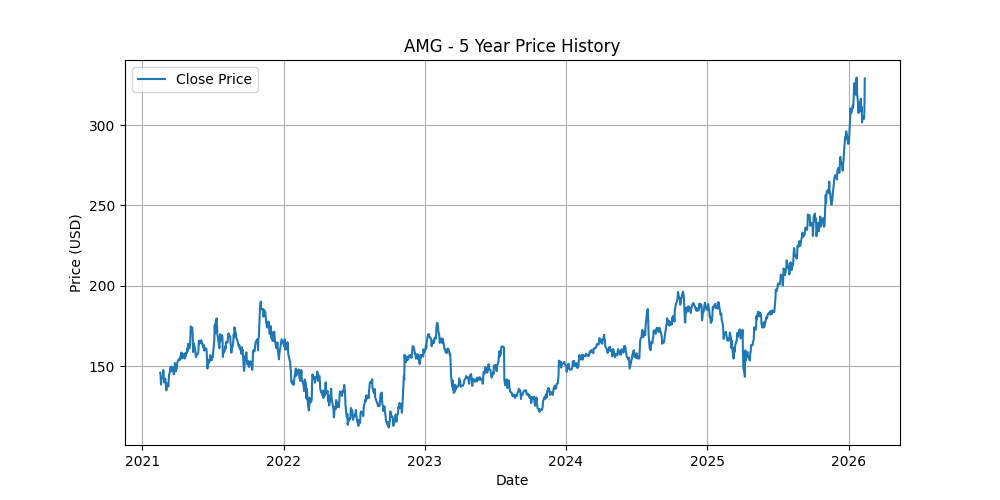

Price History (5 Years)

Why it was picked:

- ✅ ROE: 19.93% (>15%)

- ✅ Margin: 34.54% (>10%)

- ✅ Rev Growth: 6.20% (>5%)

- ✅ D/E: 60.86 (>=50%)

- ✅ PEG: 0.12 (<2.0)

#2 Pick: AR

PEG Ratio: 0.54 | P/E Ratio: 16.66 | Dividend Yield: N/A

Company Description

Antero Resources Corporation, an independent oil and natural gas company, engages in the development, production, exploration, and acquisition of natural gas, natural gas liquids (NGLs), and oil properties in the United States. It operates in three segments: Exploration and Production; Marketing; and Equity Method Investment in Antero Midstream. As of December 31, 2025, the company had approximately 537,000 net acres in the Appalachian Basin; and approximately 168,000 net acres in the Upper Devonian Shale. Its gathering and compression systems also comprise 731 miles of gas gathering pipelines in the Appalachian Basin. The company was formerly known as Antero Resources Appalachian Corporation and changed its name to Antero Resources Corporation in June 2013. Antero Resources Corporation was incorporated in 2002 and is headquartered in Denver, Colorado.

Industry & Sector

Industry: Oil & Gas E&P | Sector: Energy

Price History (5 Years)

Why it was picked:

- ✅ ROE: 9.04% (<=15%)

- ✅ Margin: 12.02% (>10%)

- ✅ Rev Growth: 19.80% (>5%)

- ✅ D/E: 45.706 (<50%)

- ✅ PEG: 0.54 (<2.0)

#3 Pick: AFG

PEG Ratio: 0.70 | P/E Ratio: 12.81 | Dividend Yield: 2.73%

Company Description

American Financial Group, Inc., an insurance holding company, provides specialty property and casualty insurance products in the United States. The company offers property and transportation insurance products, such as physical damage and liability coverage for buses and trucks other specialty transportation niches, inland and ocean marine, agricultural-related products, and other commercial property coverages; specialty casualty insurance, including primarily excess and surplus, executive and professional liability, general liability, umbrella and excess liability, and specialty coverage in targeted markets, as well as customized programs for small to mid-sized businesses and workers' compensation insurance; and specialty financial insurance products comprising risk management insurance programs for lending and leasing institutions, fidelity and surety products, and trade credit insurance. It sells its property and casualty insurance products through independent insurance agents and brokers. The company was founded in 1872 and is headquartered in Cincinnati, Ohio.

Industry & Sector

Industry: Insurance - Property & Casualty | Sector: Financial Services

Price History (5 Years)

Why it was picked:

- ✅ ROE: 18.31% (>15%)

- ✅ Margin: 10.62% (>10%)

- ✅ Rev Growth: -3.40% (<=5%)

- ✅ D/E: 37.759 (<50%)

- ✅ PEG: 0.70 (<2.0)

#4 Pick: AYI

PEG Ratio: 1.72 | P/E Ratio: 24.10 | Dividend Yield: 0.23%

Company Description

Acuity Inc. provides lighting, lighting controls, building management system, and an audio, video, and control platform in the United States and internationally. It operates in two segments, Acuity Brands Lighting (ABL); and the Acuity Intelligent Spaces (AIS). The ABL segment provides lighting solutions and luminaires with advanced electronics under the Aculux, American Electric Lighting, Cyclone, Dark to Light, eldoLED, Eureka, Fresco, Gotham, Healthcare Lighting, Holophane, Hydrel, IOTA, Juno, Lithonia Lighting, Luminaire LED, Luminis, Mark Architectural Lighting, Nightingale, nLight, Peerless, RELOC Wiring Solutions, and SensorSwitch brand names. This segment serves electrical distributors, consumer retailers, large corporate accounts, and original equipment manufacturer customers. The AIS segment offers Distech Controls intelligent Building Management Systems (BMS), such as products for controlling heating, ventilation, air conditioning, lighting, shades, refrigeration, and building access that prioritize end-user outcomes; Q-SYS, a full-stack audio, video, and control platform, and QSC Audio, an audio technology for live entertainers and sound reinforcement professionals. This segment serves retail stores, airports, universities, enterprise campuses, sports venues, themed entertainment, and hospitality sectors through system integrators. It offers its products and solutions under the Atrius, Distech Controls, QSC, and KE2 Therm Solutions brands. Acuity Inc. was formerly known as Acuity Brands, Inc. and changed its name to Acuity Inc. in March 2025. Acuity Inc. was incorporated in 2001 and is headquartered in Atlanta, Georgia.

Industry & Sector

Industry: Electrical Equipment & Parts | Sector: Industrials

Price History (5 Years)

Why it was picked:

- ✅ ROE: 15.61% (>15%)

- ✅ Margin: 9.04% (<=10%)

- ✅ Rev Growth: 20.20% (>5%)

- ✅ D/E: 32.573 (<50%)

- ✅ PEG: 1.72 (<2.0)

#5 Pick: APPF

PEG Ratio: N/A | P/E Ratio: 45.23 | Dividend Yield: N/A

Company Description

AppFolio, Inc., together with its subsidiaries, provides cloud-based platform for the real estate industry in the United States. The company provides a cloud-based platform that assist with accounting, reporting, marketing, leasing, maintenance, workflow automation, and communication services. It offers AppFolio Property Manager Core, a platform that provides the accounting functionalities for small property management companies, as well as serves as a system of record; AppFolio Property Manager Plus, which offers affordable housing and student housing, advanced accounting, advanced data analysis, and read-only API access services; and AppFolio Property Manager Max that provides customer relationship management tools and full database access through a read and write application programming interface services. The company also provides value-added services, such as electronic payment, tenant screening, maintenance, business optimization, resident, and risk mitigation services. It serves property managers, property investors, potential residents, residents, and vendors. AppFolio, Inc. was incorporated in 2006 and is headquartered in Santa Barbara, California.

Industry & Sector

Industry: Software - Application | Sector: Technology

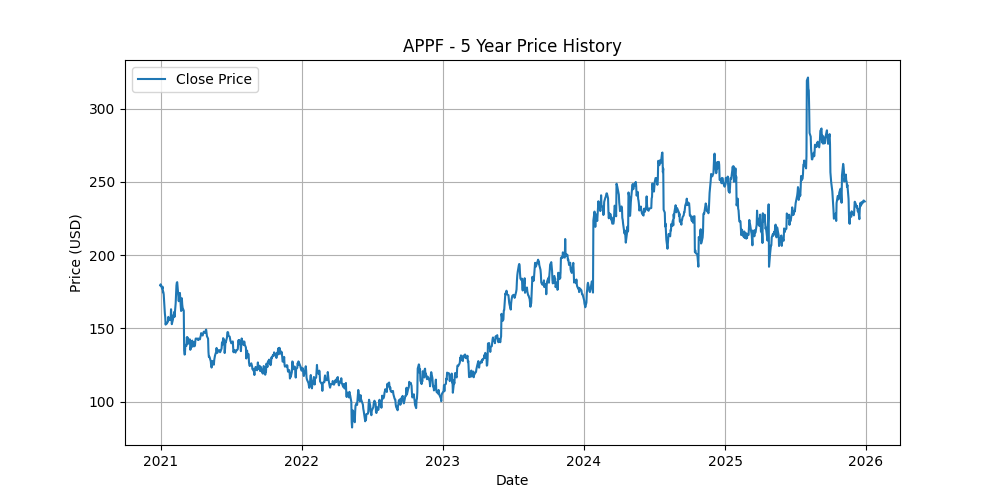

Price History (5 Years)

Why it was picked:

- ✅ ROE: 26.54% (>15%)

- ✅ Margin: 14.82% (>10%)

- ✅ Rev Growth: 21.90% (>5%)

- ✅ D/E: 7.033 (<50%)

- ✅ PEG: N/A (>=2.0 or invalid)

Historical Top Picks

| Date | Ticker | Score | PEG | P/E | Div Yield |

|---|---|---|---|---|---|

| 2026-02-13 | AMG | 4 | 0.12 | 14.47 | 0.01% |

| 2026-02-13 | AR | 4 | 0.54 | 16.66 | N/A |

| 2026-02-13 | AFG | 4 | 0.70 | 12.81 | 2.73% |

| 2026-02-13 | AYI | 4 | 1.72 | 24.10 | 0.23% |

| 2026-02-13 | APPF | 4 | N/A | 45.23 | N/A |

| 2026-02-12 | AFG | 4 | 0.70 | 12.78 | 2.73% |

| 2026-02-12 | AM | 4 | 1.30 | 20.86 | 4.40% |

| 2026-02-12 | AYI | 4 | 1.77 | 24.75 | 0.22% |

| 2026-02-12 | APPF | 4 | N/A | 46.07 | N/A |

| 2026-02-12 | BHF | 3 | 0.02 | 4.49 | N/A |

| 2026-02-11 | AFG | 4 | 0.70 | 12.84 | 2.72% |

| 2026-02-11 | AM | 4 | 1.27 | 20.31 | 4.52% |

| 2026-02-11 | AYI | 4 | 1.82 | 25.52 | 0.21% |

| 2026-02-11 | APPF | 4 | N/A | 48.53 | N/A |

| 2026-02-11 | BHF | 3 | 0.02 | 4.48 | N/A |

| 2026-02-10 | AFG | 4 | 0.70 | 12.85 | 2.72% |

| 2026-02-10 | AM | 4 | 1.26 | 20.14 | 4.56% |

| 2026-02-10 | AYI | 4 | 1.82 | 25.45 | 0.21% |

| 2026-02-10 | APPF | 4 | N/A | 47.37 | N/A |

| 2026-02-10 | BHF | 3 | 0.02 | 4.47 | N/A |

| 2026-02-09 | AFG | 4 | 0.71 | 13.00 | 2.69% |

| 2026-02-09 | AM | 4 | 1.22 | 19.57 | 4.69% |

| 2026-02-09 | AYI | 4 | 1.80 | 25.26 | 0.22% |

| 2026-02-09 | APPF | 4 | N/A | 46.32 | N/A |

| 2026-02-09 | BHF | 3 | 0.02 | 4.48 | N/A |

| 2026-02-06 | ATR | 5 | 0.67 | 19.87 | 1.50% |

| 2026-02-06 | AFG | 4 | 0.70 | 12.87 | 2.71% |

| 2026-02-06 | AM | 4 | 1.21 | 19.29 | 4.76% |

| 2026-02-06 | AYI | 4 | 1.74 | 24.32 | 0.22% |

| 2026-02-06 | APPF | 4 | N/A | 45.71 | N/A |