Daily Stock Picks: S&P 500

#1 Pick: ALL

PEG Ratio: 0.05 | P/E Ratio: 5.43 | Dividend Yield: 2.09%

Company Description

The Allstate Corporation, together with its subsidiaries, provides property and casualty, and other insurance products in the United States and Canada. It operates in five segments: Allstate Protection; Run-off Property-Liability; Protection Services; Allstate Health and Benefits; and Corporate and Other. The company offers private passenger auto, homeowners, personal lines, and commercial insurance products through agents, contact centers, and online; and property and casualty insurance products. It also provides consumer product protection plans, device and mobile data collection services, and analytic solutions using automotive telematics information, roadside assistance, and protection plans; and insurance products, such as identity protection and restoration through Allstate Protection Plans, Allstate Dealer Services, Allstate Roadside, Arity, and Allstate Identity Protection brands. In addition, the company offers life, accident, critical illness, hospital indemnity, short-term disability, and other health insurance products; self-funded stop-loss and fully insured group health products to employers; medicare supplement, ancillary products, and short-term medical insurance to individuals through independent agents, owned agencies, benefits brokers, and Allstate exclusive agents. Further, it offers automotive protection; vehicle service contracts, guaranteed asset protection, road hazard tires and wheels, and paintless dent repair protection; and roadside assistance, mobility data collection services, and analytic solutions using automotive telematics information, identity theft protection, and remediation services. The Allstate Corporation was founded in 1931 and is headquartered in Northbrook, Illinois.

Industry & Sector

Industry: Insurance - Property & Casualty | Sector: Financial Services

Price History (5 Years)

Why it was picked:

- ✅ ROE: 39.52% (>15%)

- ✅ Margin: 15.19% (>10%)

- ✅ Rev Growth: 5.10% (>5%)

- ✅ D/E: 24.486 (<50%)

- ✅ PEG: 0.05 (<2.0)

#2 Pick: ACGL

PEG Ratio: 0.22 | P/E Ratio: 8.61 | Dividend Yield: N/A

Company Description

Arch Capital Group Ltd., together with its subsidiaries, provides insurance, reinsurance, and mortgage insurance products in the United States, Canada, Bermuda, the United Kingdom, Europe, and Australia. The Insurance segment offers commercial automobile; commercial multiperil; financial and professional line liability; admitted, excess, and surplus casualty lines; property and short-tail specialty; workers compensation; casualty; marine and aviation; excess and surplus casualty; construction and national accounts; alternative market risks and employer's liability; travel, accident, and health; contract and commercial surety coverage; and other insurance products, as well as Lloyd's syndicates; programs; and warranty and lenders solutions. Its Reinsurance segment provides reinsurance products for casualty; marine and aviation; property catastrophe; property excluding property catastrophe; and other specialty products. The Mortgage segment offers U.S. primary mortgage insurance business written predominantly on loans sold to the Federal National Mortgage Association and Federal Home Loan Mortgage Corporation; reinsurance and underwriting services related to the U.S. credit-risk transfer business and other U.S. mortgage reinsurance transactions; and international mortgage insurance and reinsurance business covering loans. It markets its products through a group of licensed independent retail and wholesale brokers. The company was formerly known as Risk Capital Holdings, Inc. Arch Capital Group Ltd. was founded in 1995 and is headquartered in Pembroke, Bermuda.

Industry & Sector

Industry: Insurance - Diversified | Sector: Financial Services

Price History (5 Years)

Why it was picked:

- ✅ ROE: 19.54% (>15%)

- ✅ Margin: 22.07% (>10%)

- ✅ Rev Growth: 8.50% (>5%)

- ✅ D/E: 11.274 (<50%)

- ✅ PEG: 0.22 (<2.0)

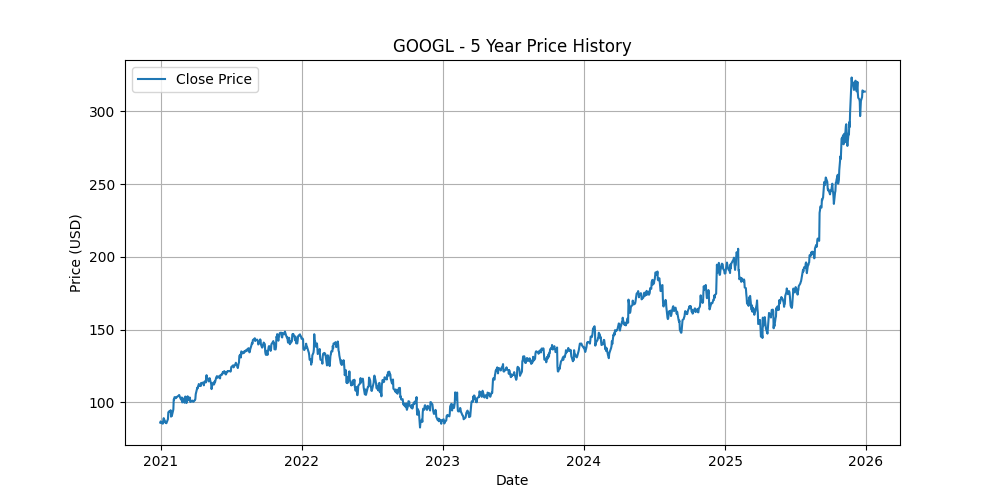

#3 Pick: GOOGL

PEG Ratio: 0.92 | P/E Ratio: 28.56 | Dividend Yield: 0.27%

Company Description

Alphabet Inc. offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America. It operates through Google Services, Google Cloud, and Other Bets segments. The Google Services segment provides products and services, including ads, Android, Chrome, devices, Gmail, Google Drive, Google Maps, Google Photos, Google Play, Search, and YouTube. It is also involved in the sale of apps and in-app purchases and digital content in Google Play and YouTube; and devices, as well as the provision of YouTube consumer subscription services, such as YouTube TV, YouTube Music and Premium, NFL Sunday Ticket, and Google One. The Google Cloud segment offers consumption-based fees and subscriptions for AI solutions, including AI infrastructure, Vertex AI platform, and Gemini enterprise. It also provides cybersecurity, and data and analytics services; Google Workspace that include cloud-based communication and collaboration tools for enterprises, such as Calendar, Gmail, Docs, Drive, and Meet; and other enterprise services. The Other Bets segment sells transportation and internet services. Alphabet Inc. was incorporated in 1998 and is headquartered in Mountain View, California.

Industry & Sector

Industry: Internet Content & Information | Sector: Communication Services

Price History (5 Years)

Why it was picked:

- ✅ ROE: 35.71% (>15%)

- ✅ Margin: 32.81% (>10%)

- ✅ Rev Growth: 18.00% (>5%)

- ✅ D/E: 16.133 (<50%)

- ✅ PEG: 0.92 (<2.0)

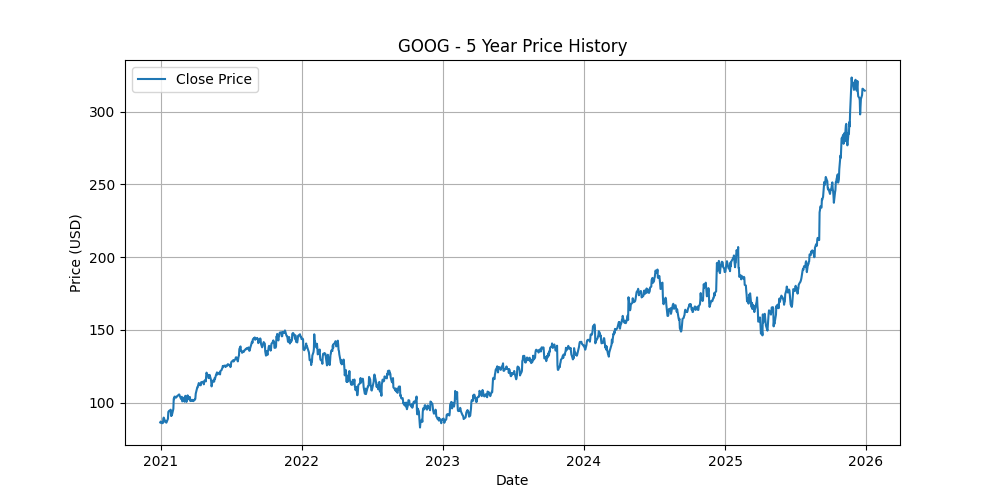

#4 Pick: GOOG

PEG Ratio: 0.92 | P/E Ratio: 28.65 | Dividend Yield: 0.27%

Company Description

Alphabet Inc. offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America. It operates through Google Services, Google Cloud, and Other Bets segments. The Google Services segment provides products and services, including ads, Android, Chrome, devices, Gmail, Google Drive, Google Maps, Google Photos, Google Play, Search, and YouTube. It is also involved in the sale of apps and in-app purchases and digital content in Google Play and YouTube; and devices, as well as the provision of YouTube consumer subscription services, such as YouTube TV, YouTube Music and Premium, NFL Sunday Ticket, and Google One. The Google Cloud segment offers consumption-based fees and subscriptions for AI solutions, including AI infrastructure, Vertex AI platform, and Gemini enterprise. It also provides cybersecurity, and data and analytics services; Google Workspace that include cloud-based communication and collaboration tools for enterprises, such as Calendar, Gmail, Docs, Drive, and Meet; and other enterprise services. The Other Bets segment sells transportation and internet services. Alphabet Inc. was incorporated in 1998 and is headquartered in Mountain View, California.

Industry & Sector

Industry: Internet Content & Information | Sector: Communication Services

Price History (5 Years)

Why it was picked:

- ✅ ROE: 35.71% (>15%)

- ✅ Margin: 32.81% (>10%)

- ✅ Rev Growth: 18.00% (>5%)

- ✅ D/E: 16.133 (<50%)

- ✅ PEG: 0.92 (<2.0)

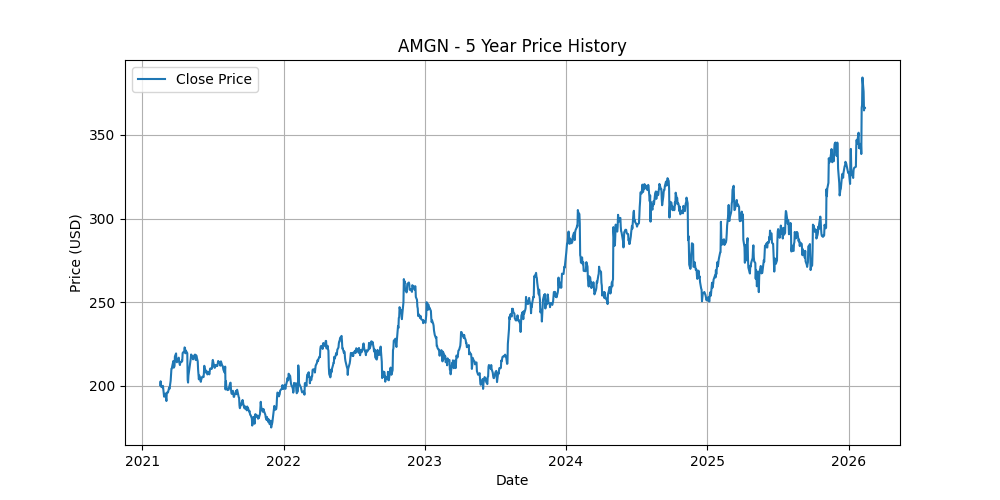

#5 Pick: AMGN

PEG Ratio: 0.23 | P/E Ratio: 25.70 | Dividend Yield: 2.64%

Company Description

Amgen Inc. discovers, develops, manufactures, and delivers human therapeutics worldwide. The company's principal products include Enbrel for the treatment of rheumatoid arthritis, plaque psoriasis, and psoriatic arthritis; Otezla for the treatment of adult patients with plaque psoriasis, psoriatic arthritis, and oral ulcers associated with Behçet's disease; Prolia to treat postmenopausal women with osteoporosis; XGEVA for skeletal-related events prevention; Repatha, which reduces the risks of myocardial infarction, stroke, and coronary revascularization; Nplate for the treatment of patients with immune thrombocytopenia; KYPROLIS to treat patients with relapsed or refractory multiple myeloma; Aranesp to treat a lower-than-normal number of red blood cells and anemia; EVENITY for the treatment of osteoporosis in postmenopausal for men and women; Vectibix to treat patients with wild-type RAS metastatic colorectal cancer; BLINCYTO for the treatment of patients with acute lymphoblastic leukemia; TEPEZZA to treat thyroid eye disease; and KRYSTEXXA for the treatment of chronic refractory gout. It also markets other products, including Neulasta, MVASI, AMJEVITA/AMGEVITA, TEZSPIRE, Parsabiv, Aimovig, LUMAKRAS/LUMYKRAS, EPOGEN, KANJINTI, TAVNEOS, RAVICTI, UPLIZNA and PROCYSBI. The company serves healthcare providers, including physicians or their clinics, dialysis centers, hospitals, and pharmacies. It distributes its products through pharmaceutical wholesale distributors, as well as direct-to-consumer channels. The company has collaboration agreements with AstraZeneca plc for the development and commercialization of TEZSPIRE; Novartis Pharma AG to develop and commercialize Aimovig; UCB for the development and commercialization of EVENITY; Kyowa Kirin Co., Ltd. for rocatinlimab development and commercialization; and BeiGene, Ltd. for oncology products expansion and development. Amgen Inc. was incorporated in 1980 and is headquartered in Thousand Oaks, California.

Industry & Sector

Industry: Drug Manufacturers - General | Sector: Healthcare

Price History (5 Years)

Why it was picked:

- ✅ ROE: 106.10% (>15%)

- ✅ Margin: 20.98% (>10%)

- ✅ Rev Growth: 8.60% (>5%)

- ✅ D/E: 630.677 (>=50%)

- ✅ PEG: 0.23 (<2.0)

Historical Top Picks

| Date | Ticker | Score | PEG | P/E | Div Yield |

|---|---|---|---|---|---|

| 2026-02-13 | ALL | 5 | 0.05 | 5.43 | 2.09% |

| 2026-02-13 | ACGL | 5 | 0.22 | 8.61 | N/A |

| 2026-02-13 | GOOGL | 5 | 0.92 | 28.56 | 0.27% |

| 2026-02-13 | GOOG | 5 | 0.92 | 28.65 | 0.27% |

| 2026-02-13 | AMGN | 4 | 0.23 | 25.70 | 2.64% |

| 2026-02-12 | ALL | 5 | 0.05 | 5.38 | 2.11% |

| 2026-02-12 | ACGL | 5 | 0.22 | 8.50 | N/A |

| 2026-02-12 | GOOGL | 5 | 0.92 | 28.74 | 0.27% |

| 2026-02-12 | GOOG | 5 | 0.93 | 28.82 | 0.27% |

| 2026-02-12 | AMGN | 4 | 0.23 | 25.78 | 2.64% |

| 2026-02-11 | ALL | 5 | 0.05 | 5.29 | 2.15% |

| 2026-02-11 | ACGL | 5 | 0.22 | 8.44 | N/A |

| 2026-02-11 | GOOGL | 5 | 0.95 | 29.50 | 0.26% |

| 2026-02-11 | GOOG | 5 | 0.95 | 29.50 | 0.26% |

| 2026-02-11 | AIZ | 4 | 0.14 | 14.41 | 1.42% |

| 2026-02-10 | ALL | 5 | 0.05 | 5.25 | 2.16% |

| 2026-02-10 | ACGL | 5 | 0.21 | 8.28 | N/A |

| 2026-02-10 | GOOGL | 5 | 0.97 | 30.03 | 0.26% |

| 2026-02-10 | GOOG | 5 | 0.97 | 30.04 | 0.26% |

| 2026-02-10 | AIZ | 4 | 0.14 | 14.35 | 1.43% |

| 2026-02-09 | ALL | 5 | 0.05 | 5.45 | 2.08% |

| 2026-02-09 | ACGL | 5 | 0.24 | 9.46 | N/A |

| 2026-02-09 | GOOGL | 5 | 0.96 | 29.84 | 0.26% |

| 2026-02-09 | GOOG | 5 | 0.96 | 29.86 | 0.26% |

| 2026-02-09 | AIZ | 4 | 0.14 | 14.84 | 1.38% |

| 2026-02-06 | ALL | 5 | 0.05 | 5.65 | 1.86% |

| 2026-02-06 | ACGL | 5 | 0.24 | 9.56 | N/A |

| 2026-02-06 | AMZN | 5 | 0.86 | 31.45 | N/A |

| 2026-02-06 | GOOGL | 5 | 0.98 | 30.67 | 0.25% |

| 2026-02-06 | GOOG | 5 | 0.98 | 30.68 | 0.25% |